Content

- The Easy Part of Owning a Business

- Amazon FinTech Tax Technical Product Manager job openings

- Why are selling, general, and administrative expenses not included in the calculation of product costs?

- Employment Law for Business and Human Resources Professionals Revised 4th

- The direction of movement of a glacier is best indicated by the a elevation of

- Matching Principle in Accrual Accounting

Labor costs that can be physically and conveniently traced to a product such as assembly line workers in a plant. Direct labor is also called touch labor cost. Warranty costs are a classic example of a loss contingency. Although the future cost amount, due date, and customer are not known for certain, a liability is probable and should be recognized if it can be reasonably estimated.

GENUINE PARTS CO MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. (form 10-K) – Marketscreener.com

GENUINE PARTS CO MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. (form 10-K).

Posted: Thu, 23 Feb 2023 08:00:00 GMT [source]

He is the sole author of all the materials on AccountingCoach.com. Read more about the author. A retailer’s or a manufacturer’s cost of goods sold is another example of an expense that is matched with sales through a cause and effect relationship. To illustrate the matching principle, let’s assume that a company’s sales are made entirely through sales representatives who earn a 10% commission. The commissions are paid on the 15th day of the month following the calendar month of the sales. For instance, if the company has $60,000 of sales in December, the company will pay commissions of $6,000 on January 15.

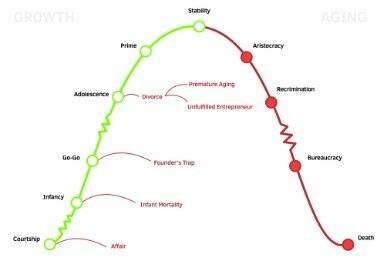

The Easy Part of Owning a Business

The matching For Inventoriable Costs To Become Expenses Under The Matching Principle A The is a part of the accrual accounting method and presents a more accurate picture of a company’s operations on the income statement. Another example is a company that pays for online marketing. The increased incremental revenue due to the marketing effort cannot be allocated directly to the cost since both the timing and amount are unknown. In this case, the online marketing spend will be treated as an expense on the income statement for the period the ads are shown, instead of when the resulting revenues are received. While it’s a valuable management tool, it isn’t GAAP-compliant and can’t be used for external reporting by public companies. Therefore, if a company uses variable costing, it may also have to use absorption costing (which is GAAP-compliant).

Recording the entry under Cost of Goods Sold helps the accountant easily match revenues with expenses. For example, a business spends $20 million on a new location with the expectation that it lasts for 10 years. The business then disperses the $20 million in expenses over the ten-year period. If there is a loan, the expense may include any fees and interest charges as part of the loan term.

Amazon FinTech Tax Technical Product Manager job openings

Expenses incurred to generate revenues must be matched against those revenues in the time periods when the revenues are recognized. For instance, a company decides to build a new office building that will improve the productivity of its employees. There is no direct way of attributing this cost to the increased revenues resulting from the increased productivity of the employees.

However, rather than the entire Capex amount being expensed at once, the $10 million depreciation expense appears on the income statement across the useful life assumption of 10 years. Deferred expense allows one to match costs of products paid out and not received yet. Any employee whose work is not necessary to create a good is said to be engaged in indirect labor. Much profit a company can gain from a specific activity into account. Product costing may be used as a basis to make these judgments.

Why are selling, general, and administrative expenses not included in the calculation of product costs?

These costs are used in the manufacturing of a product. They are regarded as assets and listed under the cost of goods sold at the time of sale. Direct materials, direct labor, and manufacturing overhead are the components required to compute it. An analyst should identify differences in companies’ expense-recognition methods and adjust reported financial statements where possible to facilitate comparability. For inventoriable costs to become expenses under the matching principle, a. The product must be finished and in stock.

- Imagine that a company pays its employees an annual bonus for their work during the fiscal year.

- Ending work in process is greater than the amount of the beginning work in process inventory.

- In addition to the distinction between manufacturing and non-manufacturing costs, there are other ways to look at costs.

- On the other side, the retailer is concerned with the cost of acquisition of product till storage cost of finished goods.

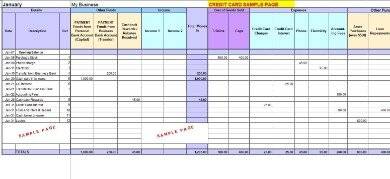

$1,850,000. $1,930,000. During 2017, $800,000 of raw materials were purchased, direct labor costs amounted to $670,000, and manufacturing overhead incurred was $640,000.

For example, you may purchase office supplies like pens, notebooks, and printer ink for your team. These items are necessary, but may not correlate to revenue. The Income statement has revenue figures at its top line. As per matching principle, only those cost which relates to the goods sold should reflect on the cost side of the income statement.

What is the matching principle quizlet?

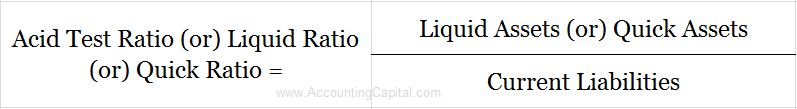

Matching Principle. The matching principle states that an expense must be recorded in the same accounting period in which it was used to produce revenue.

The manufacturer is concerned with the cost incurred from the purchase of raw materials to the storage cost of finished goods. On the other side, the retailer is concerned with the cost of acquisition of product till storage cost of finished goods. Another example would be if a company were to spend $1 million on online marketing .

For example, material handling wages, equipment utilities, and supplies for production. Direct labor costs are wages incurred to make a particular good or provide a service. For example, if a company is a table manufacturer, the people that put the table together, which are the workers and not the supervisor above them, will be considered direct labor costs. Product costs are included under the balance sheet as an asset, whereas COGS are included in the income statement. Many managers instinctively recognize that their accounting methods skew product costs and make informal modifications to compensate. However, few can foresee the exact adjustments they should make.